Essential vocabulary for this lesson. Use the dictionary to check the meaning and pronunciation:

fee royalty agent gross net profits to turn a profit licence to negotiate to lie to cheat to steal accountants shell companies to get paid to charge to get a cut of the profits to distribute to advertise to overpay / underpay to get robbed blind

You are a young actor or screenwriter making a first Hollywood film. Would you prefer a fee or a royalty?

If you choose the royalty.... you'll probably never get paid.

Why did the Return of the Jedi and Harry Potter films and the majority of Hollywood films never turn a profit?

Watch this video to get a basic understanding of the concept:

Hey Toni! Where's my f******* money?

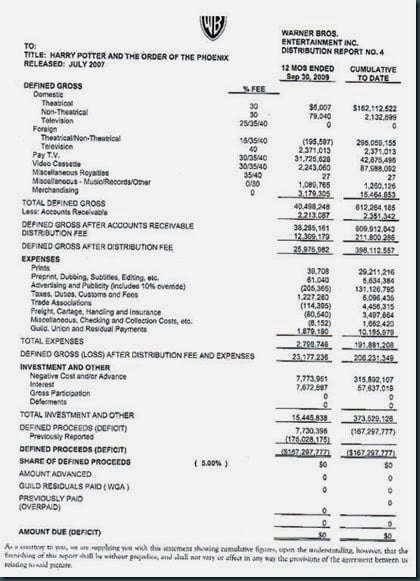

Read the balance sheet for the Harry Potter film:

What is Hollywood accounting?

It's a series of tricks pulled by Hollywood studios to make most of their movies look unprofitable, even when they're making afortune. The details are complex, but here's a simplified version:

Every studio sets up a new "shell" company for each movie. and that company is specifically designed to lose money. The studio gives that company the production budget (the number you usually see) and then also agrees to pay for marketing, advertising and related expenses in addition.

Both of those numbers represent (mostly) actual cash outlays from the studio and are reasonable to count as expenses.

Then comes the sinister part: on top of all that, the studios charge the "movie company" fees for other questionable things. Many of these fees involve no real direct expense for the studio, but basically add huge expense onto the income statement and ensure that the studio keeps getting all of the movie income, instead of having to share the profits with the important participants, even a long time after the movie would be considered profitable under regular accounting rules.

Here are Joe Rogan (world's top podcast creator) talking to Bill Burr about the typical scams and tricks that are typically used in the entertainment industry.

Here' an hypothetical example of Hollywood Accounting:

A studio funds Zak Washington - the Movie with a production budget of $100 million. It sets up ZakWashCo Inc. and gives it the production budget money. The studio then spends another $50 million on marketing and puts that down as an expense as well. With some of the big studios, some of this money involves paying itself for advertising on its own properties. You might think that ZakWashCo Inc. now needs to make back $150 million to be profitable. But... the studio (which, again, controls ZakWashCo Inc. completely) then adds onto it all, for example, a $250 million "distribution fee."

Now, while there may be some money spent on actually distributing the film, the number is almost completely bogus (false), and much higher than the actual expense for the studio. Very little actual money needs to change hands here - it's just a fee on the books (a fee they are charging to themselves). And it's not just "distribution" but a variety of additional charges. On top of that, the studio may then charge "interest" on that money, even though it's really just lending money to itself.

What it all means is that rather than becoming profitable at $150 million (the actual money spent), ZakWashCo Inc. now needs to earn over $400 million before anyone expecting a royalty sees an additional cent from the movie.

NEXT CLASS:

Explain to the group what you have learnt.

Which other industries use the same techniques?

Find some real life examples of 'creative accounting'.

Free video tutorial!

Check out our Zak Washington English learners' instruction video (released every two weeks on Youtube):